Notes Receivable Typically Arise From Sales to Customers.

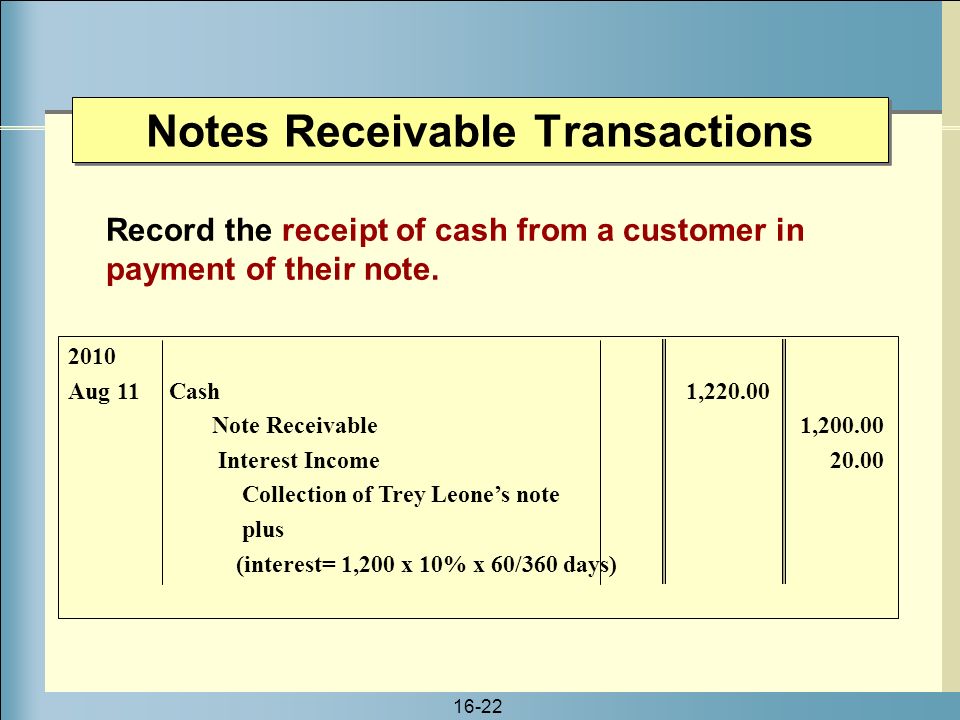

A 10000 note that has a stated interest rate of 10 and is. 116Interest on a note receivable is calculated as the face value of the note times the annual interest rate stated on the note times the fraction of the year the note is outstanding.

Chap 4 Mc Zxdcfvgbhnkjlmk Knb Docsity

Question 5-17 LO 5-7 One common difference is that notes receivable require the borrower to pay interest.

. See full answer below. The accounts receivables will be current assets when it is realizable within a normal operating cycle. Whenever accounts receivable arise from normal sales to customers regardless of the credit terms Accounts receivables are the parts of the current assets.

In this case the company could extend the payment period and require interest. 09-01 Describe accounts receivable and how they occur and are recorded. True Trade discounts represent a discount offered to the purchasers for quick payment False When a company sells a 100 service with a 20 trade discount 80 of revenue is recognized.

Notes receivable typically arise from sales to customers. Notes receivable are typically only used when a company sells large dollar value items such as cars False The allowance for doubtful account is a temporary account which is closed to retained earnings at the end of the accounting period false The accounts receivable account for each customer is called a subsidiary account True. Are similar to accounts receivable but are more formal credit arrangements evidenced by a written debt instrument or note.

Notes receivable typically earn interest revenue for the lender and interest expense for the borrower. Notes receivable are typically used for transactions of substantial amounts with customers an typically represent the single most important asset for. Easy Larson - Chapter 09 1 Learning Objective.

Receivables can be one. This helps us keep track of how much each customer owes us individually. Market research indicates that customers would be willing to pay 90 for such a widget and that 50000 units could be sold each year at this price.

Notes receivable are assets and are reported in the balance sheet. For example a company may have an outstanding account receivable in the amount of 1000. Also notes receivable typically arise not from sales to customers but from loans to other entities including affiliated companies loans to stockholders and employees and occasionally the sale of merchandise other assets or services.

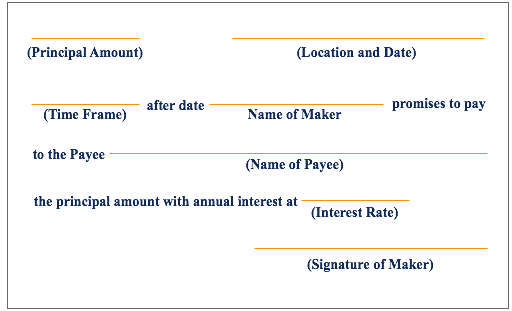

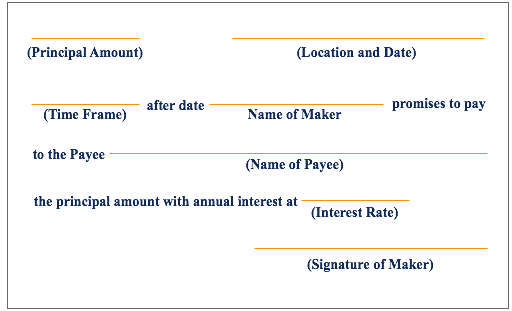

Accounts receivable arise from businesstrade transactions. Notes receivable arise from written promises to pay a specified amount at a specified time. Notes Receivable may be accepted by the seller in payment for a sale or to replace an account receivable from a prior sale.

Differences reported by customers in confirmation replies typically arise because of. Trade discounts represent a discount offered to the purchasers for quick payment. Accounts receivable on the other hand has no written agreement between seller and customer.

Notes receivable are a balance sheet item that records the value of promissory notes that a business is owed and should receive payment for. Nontrade receivables are receivables from those other than customers and include tax refund claims interest receivable and loans by the company to other entities including stockholders and. In any event the Notes Receivable account is at the face or principal of the note.

Notes receivable typically arise from sales to customers. Used to get more accurate estimate for uncollectable accounts determine the age to various accounts. Typically arise from loans to other.

Chapter 9 Key 1. The transition from accounts receivable to notes receivable can occur when a customer misses a payment on a short-term credit line for products or services. Notes receivable usually arise when accounts receivable are converted to notes receivable when the customer wants to extend the date of payment and in return agrees to pay interest.

Notes receivable is a legally binding agreement between the issuer and the payee. Notes receivable typically DOES NOT arise from sales to customers. Notes receivable only arise from sales to customers.

Notes receivable typically arise from sales to customers. These are the debtors who have taken the goods on credit. Accounts receivable represent the amount of cash owed to the company by its customers from the sale of products or services on account.

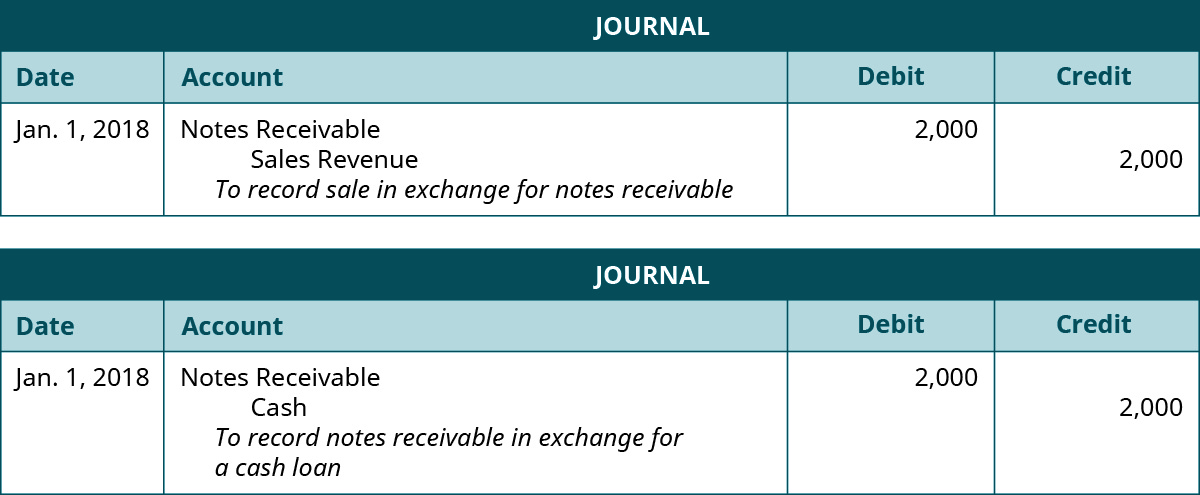

Notes receivable are similar to accounts receivable but are more formal credit arrangements evidenced by a written debt instrument or note. Other receivables arise from nonbusiness and nontrade transactions. Interest rates are typically stated as a percent per annum that is as a yearly or annual rate.

Usually a time period of thirty to ninety days is provided to clear the debt. Notes receivable only arise from sales to customers. Such agreement is recorded formally as a promissory note.

Principal of a note ____. Accounts receivable arise from credit sales to customers by both retailers and wholesalers. We will create a separate subsidiary accounts receivable ledger for each customer.

On Feb 1 2015 Middleton Corp lends cash and accepts 3100 note receivable that offers 8 interest and is due in six months. Notes bear interest for their term which is paid at the end of the term the maturity date. How much interest revenue will Middleton Corp report during.

Notes receivable are similar to accounts receivable but are more formal credit arrangements evidenced by a written debt instrument or note. Notes receivable typically earn interest revenue for the lender and interest expense for the borrower. ACCOUNTS RECEIVABLE Accounts Receivable arise from credit sales to customers.

115Notes receivable are assets and are reported in the balance sheet. The accounts receivable is the asset account which typically arises. 114Notes receivable typically arise from sales to customers.

Chapter receivables and sales aging method. The current cost to produce the widget is estimated to be 65. A written promissory note gives the holder or bearer the right to receive the amount outlined in the legal agreement.

The only document available is the sales invoice. Accounting for Notes Receivable When a note is received from a customer the Notes Receivable account is debited. The credit can be to Cash Sales or Accounts Receivable depending on the transaction that gives rise to the note.

Trade receivables are amounts receivable from customers due to credit sales.

What Are Notes Receivable Examples And Step By Step Guide

Learn The Definition Of Other Receivables Online Accounting

Explain How Notes Receivable And Accounts Receivable Differ Principles Of Accounting Volume 1 Financial Accounting

No comments for "Notes Receivable Typically Arise From Sales to Customers."

Post a Comment